Articles

Find Schedule 8812 (Function 1040) as well as guidelines to learn more. You could potentially claim a card, at the mercy of certain constraints, to own taxation you repaid otherwise accrued to a foreign nation to the international resource income. You cannot allege a card to possess taxation paid back otherwise accumulated for the excluded international earned income.

Original source site | Credible Application Company

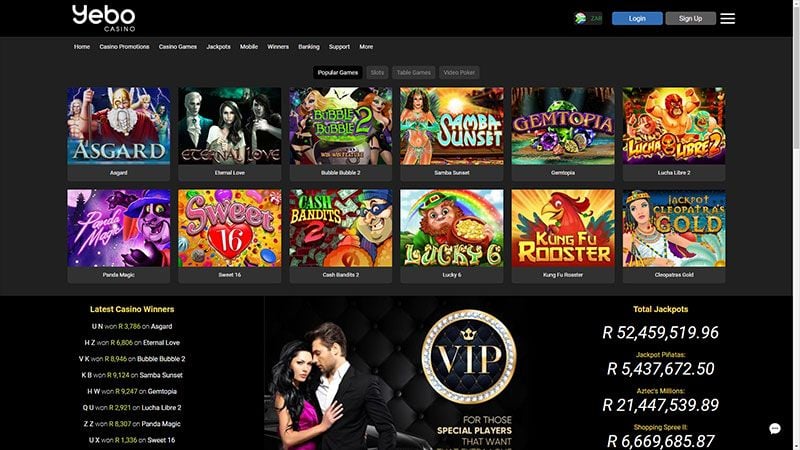

This consists of the brand new issues that basis to the „need haves“ including shelter and equity. Following that, we promotion next for the issues that be a little more of an issue away from preference such as advertisements as well as other $5 gambling games to play. Nevertheless, many of these some thing foundation to the the unique get program one to turns up with what i have good reason to believe is an informed choices available today, and now we need to show the major points that we look only. Below, you’ll find 1st conditions i review in terms to help you minute put casinos online. Incentives in the $5 minimum deposit gambling enterprises mode in the same manner as they do during the typical gambling enterprises where you must put a high sum of money to initiate playing.

Spend You.S. expenses on the go

The brand new taxable money on the rest (non‑S‑portion) of one’s ESBT is calculated in a sense in line with an excellent complex believe for the Mode 541. Enter the taxable money to your low-S-portion of the ESBT on the web 20a. The newest formula can be’t getting set through to the value of DNI is well known. In the event the a good decedent, during the go out of passing, try a resident away from Ca, the complete money of your own estate need to be claimed. When the a great decedent, from the go out from dying, is a nonresident, precisely the earnings produced by supply inside Ca might be said.

If you don’t provides an everyday otherwise head host to business original source site because of the characteristics of your own works, in that case your taxation home is the place where your on a regular basis live. Unless you complement sometimes of these categories, you’re thought a keen itinerant plus taxation home is wherever you performs. For many who be considered so you can prohibit times of presence because the an expert runner, you need to document a completely finished Form 8843 to your Internal revenue service. For those who qualify to help you prohibit days of presence while the a student, you need to file a fully accomplished Mode 8843 to your Irs. The important points and you can things to be sensed in the determining for individuals who have displayed an intent to live permanently in the us were, however they are not limited in order to, another.

- Stepping into an alternative house is expensive for most, but also for lowest-income clients, it could be thus high priced they are able to’t move.

- Paraguay also provides an application enabling individuals get permanent house immediately because of the being qualified while the buyers who will render employment and financing on the nation.

- The maximum extra-to-real-currency transformation is actually capped in the $250 for depositors.

- It is rather essential read their gambling enterprise’s terms and conditions prior to registering otherwise and then make a deposit, you know exactly what you’re entering and you can select the primary gambling establishment for your requirements.

- Staff from overseas governing bodies (in addition to international governmental subdivisions) may be able to excused their international authorities wages from You.S. taxation whenever they satisfy the conditions of any one of next.

Simply through the fool around with income tax responsibility one represents your California Modified Gross income (available on line 17) and you may enter into they on the internet 34. You will not end up being examined more fool around with income tax for the individual non-team stuff you purchased for less than $1,100 for every. If your property otherwise faith is actually an enthusiastic NCNR person in a great limited liability business (LLC) and you can taxation is actually paid off to your estate’s otherwise trust’s part from the LLC, include the NCNR people’ taxation away from Schedule K-1 (568), line 15e.

For those who have wages subject to a comparable withholding legislation you to definitely apply at U.S. residents, you should document Form 1040-NR and make very first projected taxation payment by the April 15, 2025. If you do not have wages at the mercy of withholding, document your income income tax come back to make very first estimated taxation percentage because of the Summer 16, 2025. However, if you’re not a candidate to possess a diploma and also the give does not fulfill the needs, income tax might possibly be withheld from the 31% (otherwise straight down treaty) speed.

Lotto Games

Providing Maria suits some other standards, Maria is prohibit only about $step one,500 away from money since the an experienced grant. You can’t ban of money the brand new portion of people scholarship, fellowship, or university fees protection one to is short for commission to have prior, present, otherwise coming exercises, research, or other characteristics. This can be genuine even if the applicants to have a diploma are needed to do the services since the an ailment for finding the brand new training. There may not one 29% taxation for the certain quick-term money gain returns of offer within the Us you to definitely you can get from a mutual finance or any other RIC.